Stock Market Analysis: Invest Better - RisingMove

Stock market analysis essentially consists of doing your research before investing. It involves studying companies and their financial data to make more confident decisions. This is important because stock prices fluctuate widely; analysis helps us understand why and if a company is worth buying (and keeping!).

By conducting this research, we take less risk: we are making an informed bet on a company's future.

Fundamental Analysis and Technical Analysis🔗

There are two main types of stock market analysis.

Fundamental analysis analyzes a company's activities: its revenue, profits, debt, its position among competitors, etc. This allows us to estimate the company's intrinsic value.

Fundamental analysis can reveal bargains by identifying potentially undervalued companies by comparing the stock price to the company's financial health.

Technical analysis, on the other hand, ignores history and focuses on the price itself. Traders use charts to spot trends in a stock's price and trading volume. For example, you might plot a trendline or observe a moving average on Apple's stock chart. The idea is that history often repeats itself, and past movements and trends (such as a sudden surge or the formation of a "flag") can foreshadow what's to come.

Technical analysis is often used in the short to medium term. It's probably best to just use it as an additional tool before buying a stock identified through fundamental analysis. At risingmove.com, we believe in the power of fundamentals and long-term investing, which is why we focus on fundamental analysis.

Fundamental Analysis🔗

Financial Statements🔗

Financial statements are essential to fundamental analysis. They include:

- Income Statement: Shows revenues, expenses, and profits over a given period.

- Balance Sheet: Shows assets, liabilities, and equity at a given point in time.

- Cash Flow Statement: Details cash inflows and outflows.

A thorough review allows you to identify trends, assess financial health, and estimate future earnings. For example, a company with declining revenue or increasing debt may be considered less attractive for investment than a company with steady growth and a strong balance sheet.

Industry Trends🔗

It is important to understand the industry context. This can include analyzing market share, technological advances, regulatory changes, and competition. For example, the value of the pharmaceutical industry can fluctuate based on the approval of new drugs or the expiration of patents, which has a significant impact on the future earnings potential of companies.

"Quality" Factors🔗

- Management Quality: Strong leadership can drive innovation and growth.

- Brand Reputation: A positive image of the company, or its brands, can strengthen customer loyalty and brand value.

A good example is Apple Inc. (again!), whose constant innovation, strong management team, and customer loyalty have contributed to its stock outperforming the market for years.

Where to Be Careful🔗

No analysis can predict the future with certainty. Assumptions can be invalidated by political shocks, pandemics, or regulatory changes, which are beyond our control.

-

Time Lag: Fundamental data (earnings, revenue) are based on recent data, but they are already historical. Market prices may have already changed before the fundamental data are published and interpreted.

-

Data Overload: The multitude of indicators and ratios can be confusing rather than clarifying.

Too many signals can become contradictory and "paralyze" analysis. At risingmove.com, we focus on the decisive factors, and less on daily news or certain financial data that is not decisive enough.

Some online "analyses" are more opinions or media hype. Never rely on isolated investment advice or market forecasts without verification.

Conflicts of Interest: Free sites sometimes offer sponsored content. Be wary of "hot" sectors and trending stock lists.

Stock Analysis Websites🔗

General Financial Websites🔗

Yahoo! Finance is a go-to platform for many. The platform offers investors access to financial data and news reports, as well as filtering features. Yahoo! Finance remains one of the leading websites for users to follow developments in the U.S. markets and economy, as well as news from global analysts, thanks to its comprehensive news feed. Updates and charting features are available on Google Finance, CNBC, and MarketWatch. These websites provide users with free access to information that provides timely market analysis.

Research Websites🔗

Morningstar's fundamental data analysis makes it a top choice for long-term investors. Financial ratios and company competitive advantages, as well as analyst reports (some require a subscription), are available on their platform.

The Motley Fool community offers comprehensive stock market coverage and in-depth analysis of individual stocks and broader market trends. This company's Stock Advisor service provides personalized investment advice through fundamental analysis for investors seeking long-term stock recommendations.

Seeking Alpha is an investment research platform that combines expert market analysis with contributions from its community. You'll get a variety of perspectives on a stock. Investment insights on Seeking Alpha vary considerably in quality across the platform.

Stock Analysis Tools🔗

Zacks Investment Research provides investors with financial reports that include earnings forecasts, industry rankings, and stock ratings. Fundamental analysts use this crucial information to assess a company's intrinsic value.

You can access premium content on market news and commentary via Bloomberg, Reuters, and the Wall Street Journal. The free sections of these websites offer valuable information. These news sources provide real-time updates with concise summaries of key analyses.

Use analytical tools wisely🔗

Having a tool isn't enough; it must be used wisely. Here are some tips:

-

Cross-check the information. Combining multiple data sources yields better results than a single assessment on a website or an analyst publication. It's better to consult several sources to determine stock trends.

-

Understand your psychological biases.

Yes, your preconceived notions can influence your decisions. Seeking validation may lead you to find analyses that align with your current beliefs. So consider different points of view alongside what you've already read. When you fall in love with a company, deliberately seek out analysts who identify potential risks. -

Be prepared. Research quality stocks early on, without buying, and build your list. Later, you can buy them when their price becomes attractive, with complete confidence.

-

Keep a cool head. Beware of overinvesting. With all these charts and tools available, you might be tempted to jump in and out of stocks quickly. Every trading decision or investment choice should be supported by logical reasoning rather than emotional reactions to fluctuations in market charts or unexpected events.

Benefits of Stock Analysis🔗

Improved Decision Making🔗

Thorough analysis allows you to base your decisions on rational thinking rather than emotional reactions. Many investors sold their stocks massively during the 2008 financial crisis, resulting in significant financial losses. Those who conducted thorough analysis were better able to navigate market volatility because they didn't panic during the crisis.

Risk Management🔗

Stock analysis allows you to quickly identify investments with high levels of risk. A company with poor financial performance and regulatory issues requires careful analysis before investing.

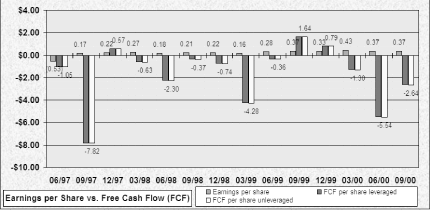

Enron Corporation is a classic example of the dangers of insufficient risk analysis. Enron often had weak cash flow, excessive debt, and "irregularities" in its financial statements. Analyzing these problems using fundamental methods would have allowed investors to detect them before Enron's bankruptcy in 2001, thus avoiding significant financial losses for shareholders.

O'Reilly Article

Long-Term Growth Opportunities🔗

Comprehensive stock market analysis helps identify undervalued stocks that generate good long-term profits. Fundamental analysis has allowed investors to predict the future leadership positions of Amazon and Google, even though these companies were initially overlooked by the market.

Disadvantages of Stock Market Analysis🔗

Time-consuming🔗

Conducting in-depth research requires a significant investment of time and effort. It takes time to review financial documents, industry reports, and even regulatory filings.

Market Efficiency🔗

The efficient market theory suggests that stock prices already incorporate most available information, making further analysis unnecessary unless new data emerges. But this is a theory that is subject to controversy.

Invest Thoughtfully🔗

Stock analysis is a major asset for investors, but it's no guarantee of quick success every time.

Stock prices experience unpredictable fluctuations. It's therefore best to set realistic goals. The average annual return of stock markets is around 7% to 10% excluding inflation, although some years post double-digit returns.

Your investment strategy must include a minimum of diversification, as investing all your funds in a single stock or sector is too risky. Think long-term. The value of many tech companies has taken several years of fluctuations before stabilizing.

In summary, use stock market analysis as a guide. It helps you focus on objective facts, but it's no substitute for prudence. By doing your research—by reading reports and questioning your assumptions—you'll avoid the pitfalls of guesswork. And when the markets are shaken up, you'll be better able to hold your positions, rather than being caught off guard.

Thanks to the photographers, graphic designers, and brand owners: